In 2025, Dabba Traders are Navigating a complex Financial Environment of inflation, ups and sizes of global stresses. With the swinging and foreign currency in the Stock markets under pressure, precious metals are once again in the headlines.

But every box remains an important question for the businessman:

Gold or Silver – What is a better option in 2025?

This article breaks both metals in terms of volatility, profitability, demand outlook and Dabba Trading Strategy – So that you can make informed decisions and maximize your trades.

The Role of Precious Metals in Dabba Trading

On a Dabba Trading Platform, you do not physically do gold or silver – you simply speculate on price movements. This means that entry point, instability and trend directions are more important than physical distribution or storage.

Both gold and silver can be traded, such as on Dabba Trading Platforms like Arrowtrad, but their behavior is very different:

- Gold provides stability, slow speed and reliable safe-horn status.

- Silver provides high volatility, rapid price swings and strong industrial demand.

Gold in 2025: Still the King of Safe-Havens?

Gold performed well in early 2025, which climbed more than 12% year-on-year. It is powered by an increase:

- Central bank procurement (especially from BRICS nations)

- Weakness in global currencies, especially INR and JPY

- Ongoing geopolitical concerns

For box traders, gold offered:

- Smooth value action

- Reliable support/resistance area

- Trend-off

Why Dabba Traders Prefer Gold:-

- It is easy to manage for intraday and swing positions

- Low risk of false breakout

- Fits well with risky strategies

Silver in 2025: High Risk, High Reward?

Silver has outpaced gold in 2025 so far — up nearly 18%. The surge is powered by:

- Rising demand from solar energy, EVs, and electronics

- Green energy policies like Made in China 2025

- Investors seeking cheaper alternatives to gold

But silver is known for its volatility — wild intraday movements are common.

Why Dabba Traders Love Silver:-

- Perfect for scaling and breakout strategies

- Low entry cost compared to gold

- Fast moves = Possibility of quick profit (if it is time)

Note: The same instability that makes silver exciting can also increase your loss if the trend quickly changes.

Gold vs Silver – Dabba Trading Comparison Table

| Feature | Gold | Silver |

|---|---|---|

| 2025 Price Performance | +12% YTD | +18% YTD |

| Volatility Level | Low to Medium | High |

| Industrial Demand | Low | Very High (EVs, Solar) |

| Ideal Strategy | Swing & Positional Trading | Scalping & Intraday Breakouts |

| Price Range on Dabba Apps | ₹70,000–74,000 (per 10g approx.) | ₹83,000–88,000 (per kg approx.) |

| Risk Level | Lower | Higher |

Strategy Tips for Dabba Trader’s in 2025

When to Choose Gold:-

- During Geographical Uncertainty (War, Election) For low Risk, Trend-Nims

- For Low Risk, Trend-Nims

When to Choose Silver:

- When industrial metals are rally (copper, aluminum also)

- For short -term trading windows with speed

- If you are a high-existence or high-risk merchant

Many Dabba Traders Are Choosing Both

Experienced traders on platforms like ArrowTrad or local Dabba Terminals are diversifying:

- 60% gold (for main positions)

- 40% silver (for instability plays)

This mixture allows you to ride trends with gold and hold fast swings with silver – balance the risk and reward.

Trade Gold and Silver Seamlessly on Dabba Trading Platforms:-

Today’s Dabba Trading Apps offered:

- Real time MCX data

- 0% brokerage

- Accelerated withdrawal

- 500x leverage for intraday

- No Tax/GST Hassles

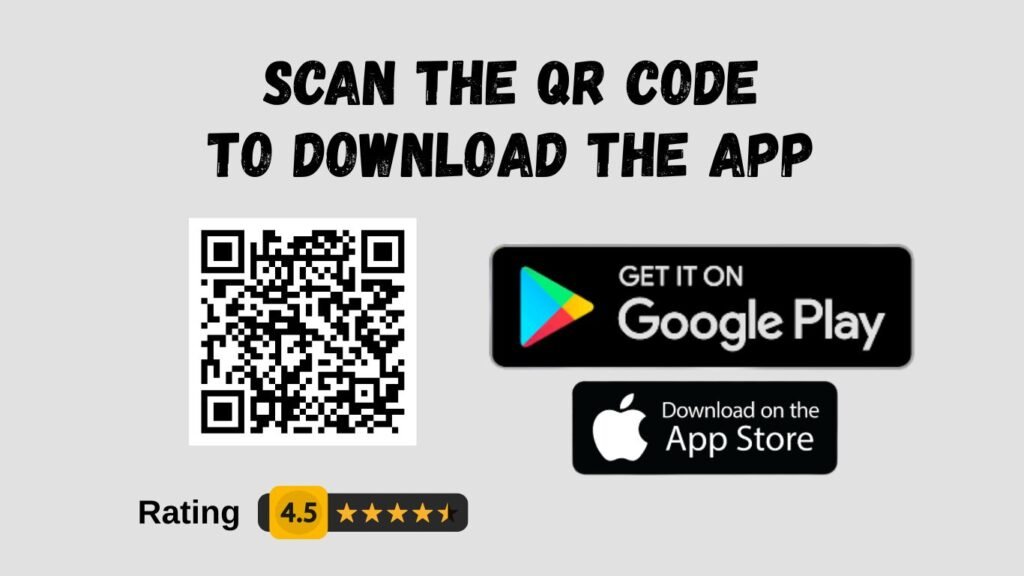

If you are using a reliable Dabba Trading platform like Arrowtrad, you can trade both effectively – Anytime, Anywhere, Anywhere, Gold and Silver.

Final Verdict: Gold or Silver – What Should Dabba Traders Choose?

Choose gold if you want:

- More stability

- Long term trend

- Low -emotional stress

Choose Silver if you want:

- High returns

- More action

- Scaling or breakout strategies

Smart moves: Diversity. In the Unpredictable Market of 2025, Dabba Traders who divide positions between the two metals are better preserved.